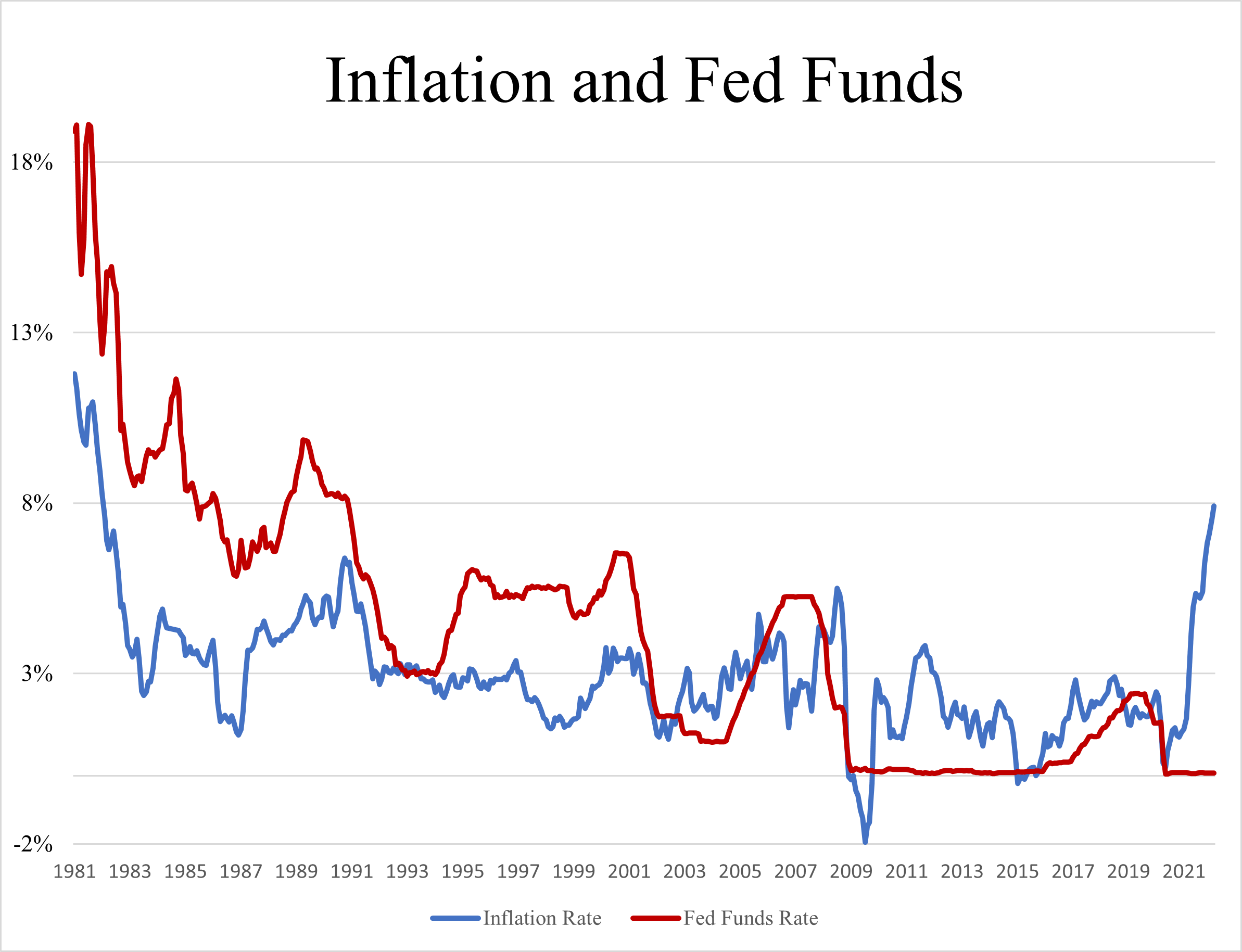

Inflation is at nearly 8%, unemployment is down to 3.6%, and the Federal Funds Rate (the Fed's main policy rate) is 0.33% or almost -8% in real (inflation adjusted) terms. If you asked any credible economist if such a thing were possible a year, or even 30 years ago they never would have believed it. The picture below plots the Fed Funds Rate and the annual inflation rate since the 1980s. Normally, the Fed Funds Rate is bigger than inflation because the neutral rate is presumed to be a positive number after you account for inflation. When the Fed Funds Rate is at the neutral level the Fed is no longer trying to juice the economy by propping up demand. Right now it is far from neutral, so the Fed is still trying to increase demand and wages, even though inflation is high and unemployment low. If inflation persists above 2%, it seems the Fed has no plans to change course.

Fed Governor Lael Brainard said she expects the Fed to increase rates to neutral this year. But at today's inflation rate that would mean at least 8%, which seems unlikely given the Fed's current plans.

Source: FRED

Allison Schrager is a senior fellow at the Manhattan Institute. Follow her on Twitter here.